Upcoming Road Tax Changes for Electric and Low-Emission Vehicles from April 2025

Starting from 1 April 2025, all

electric and low-emission vehicle owners will be required to pay road tax, also

known as Vehicle Excise Duty (VED), for the first time. This new regulation,

introduced by the UK government, will apply to all drivers, including private

hire drivers using fully electric vehicles.

At Capital Hire Management Ltd,

we understand that this change may be disappointing for EV hirers, as the road

tax exemption has been a significant financial incentive for switching to

electric.

While this decision is beyond our

control, we remain committed to supporting private hire drivers by ensuring

that electric vehicles remain an affordable and practical choice for their

business needs.

What Are the Changes to EV

Road Tax in 2025?

Currently, fully electric

vehicles are exempt from road tax. However, from 1 April 2025, this

exemption will end, affecting both new and existing zero or low-emission

vehicles.

Key points for private hire

drivers:

- Standard EV Road Tax Rate: If your electric vehicle

was registered between 1 April 2017 and 31 March 2025, you will need to

pay the standard rate of £195 per year, which is the lowest tax band.

- First-Year VED: Any new electric vehicles

registered from 1 April 2025 will pay a reduced first-year rate of £10

before moving to the standard rate of £195 from the second year onwards.

- Luxury Car Supplement: EVs with a retail price of

£40,000 or more will be subject to an additional annual charge of £410 for

five years, aligning them with other non-electric vehicles in the same

price category.

- Plug-in Hybrids: Hybrid vehicles will no longer

receive a tax discount. Any hybrid cars registered after 1 April 2017 will

also be subject to the standard annual road tax rate of £195.

For comprehensive information,

check the official UK government website: Vehicle tax for electric, zero or low emission vehicles

How Capital Hire Management

Ltd Supports Private Hire Drivers

We acknowledge that this change

introduces an added financial responsibility for drivers and hirer companies.

To simplify this transition, we are ensuring that our drivers experience

minimal inconvenience.

When you rent an electric vehicle

through Capital Hire

Management Ltd for PCO Car

Hire—the standard road tax charge of £195 and the £410 luxury car

supplement (if applicable) will be incorporated into your weekly payments for

all new zero-emission vehicles registered from 1 April 2025.

This ensures that drivers won’t

face unexpected costs, allowing for predictable expenses and peace of mind.

Why EVs Remain a

Cost-Effective Choice for Private Hire Drivers

Despite the introduction of road

tax for electric vehicles, they remain a more economical option compared to

petrol, diesel, or hybrid alternatives.

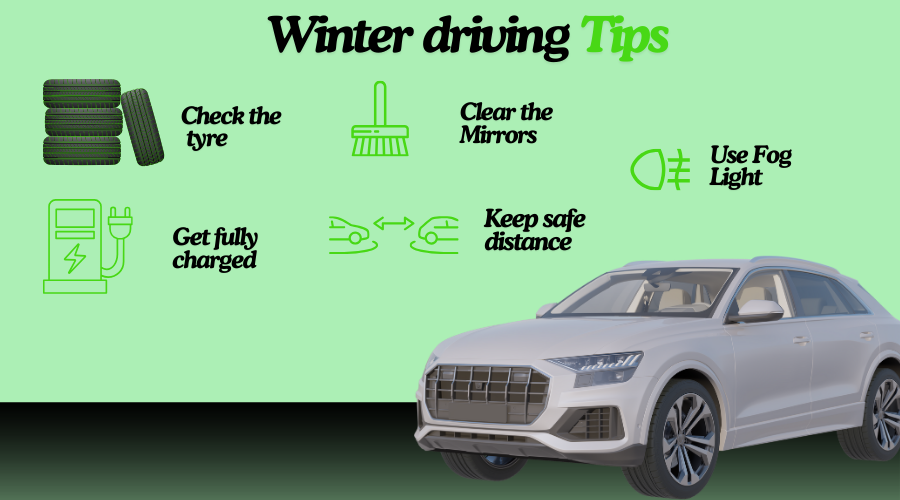

Switching to an EV still offers

significant savings due to:

- Lower fuel costs compared to petrol and diesel

- Reduced maintenance expenses due to fewer

mechanical components

- Environmental benefits and compliance with clean

air regulations

By driving an electric vehicle,

private hire drivers can maximize their earnings while enjoying a smoother and

more efficient driving experience on UK roads.

Now is the perfect time to make

the switch to electric—reduce costs, increase savings, and drive a cleaner,

more sustainable vehicle.

About Capital Hire management

Capital Hire Management Ltd. is

London's best PCO car rental company, which provides top-notch vehicles and

exceptional services to professional drivers like you! If you are looking for

affordable car hire for PCO car rental please visit our website https://www.capitalhiremanagement.co.uk/

to explore our latest fleet.

our excellence is validated by

driver ratings on Trustpilot.

we offer access to new or recent model cars along with comprehensive training

and support to enhance your profitability, safety, and overall satisfaction as

an Uber driver.

Visit our London Hub located at 56 High

Street Wealdstone Harrow HA3 7AF, London, reach out via email to us, or give us a

call at 0208426005 to get started.